A bite of the Big Apple

By Edwin Josue

One of the most emotional and financially important decisions in a person’s life is a purchase, sale or lease of a home especially if one is to live in the greatest capital of the world: New York City. Dubbed as the vertical city, one has to learn a whole gamut of contract and legalese terms, possession of a deeded title or buying of shares, representation, closing and other related real estate matters.

It is highly recommended that one has to select a team of real estate professionals to guide you throughout the process – a team usually composed of a real estate broker, a real estate lawyer, and a bank loan officer or mortgage broker.

New York City is comprised mainly of cooperative and condominium apartments with a smaller selection of private homes, which we call townhouses or brownstones. It is important to understand the differences among these types of building apartments if one is to find a place in Manhattan or its surrounding boroughs.

Types of Ownership

Condominiums

The ownership of a condominium apartment is similar to the ownership of real property. A purchaser of a condo takes title by deed for not only the apartment but also a percentage of the building’s common areas. Each owner pays property taxes to the city and common charges to the Board of Managers for their individual units. Real estate taxes may be deductible, however common charges are not.

The Board of Managers is elected by the condo residents to oversee building operations and enforcement of the “house rules.” The board uses the common charges to pay employees, as well as repair and improve the building. Condominium transactions include a “right of first refusal” by the Board within 20-30 days from receipt of a completed application.

Cooperatives

Cooperatives, or co-ops, comprise a significant portion of New York City’s real estate market. When purchasing a cooperative apartment, one purchases shares of stock in a corporation that owns the building and usually the land beneath. A stock certificate representing the purchased shares and a proprietary lease giving the right to occupy the apartment are conveyed at closing.

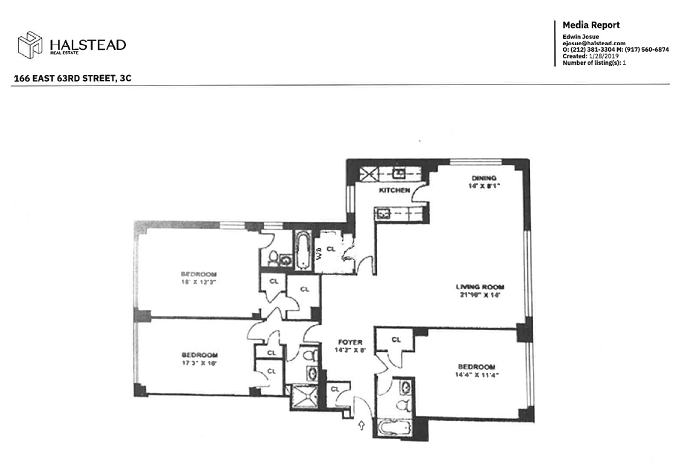

FEATURED PROPERTY

166 East 63rd Street, Apt 3C

NY/NY 10065

Postwar Condo $2.4 M

The size of the apartment and its amenities determine the number of allocated shares, which therefore determines the amount of maintenance. Maintenance fees cover the operating costs of the building such as upkeep of common areas, staff salaries, as well as payment of real estate taxes and interest on any underlying building mortgage.

A Board of Directors, whose duty is to conduct the business of the corporation and oversee the management company of the building, is elected from among the shareholders. Typically, the Board or an interview committee reviews the application of each prospective shareholder or lessee and presides over a personal interview prior to approving any purchase or lease. The Board has the right to approve or deny any applicant without cause.

Most co-ops require shareholders to occupy their apartments as primary residences; however, depending on the building, there may be an allowance for subletting. A prospective lessor is required to submit a formal application and personally interview with the Board for its approval. Duration varies from building to building, so be sure to ask your agent to confirm.

Condops

By definition, a condop is a residential cooperative where the ground floor (typically commercial units) is converted into a separate condominium owned by either an outside investor or the original sponsor of the building. Because the owner of the condo is not the owner of the co-op, the co-op does not receive the benefit from the condo income. Cooperatives that operate in the style of a Condominium are commonly yet inaccurately referred to as condops.

Townhouses and Houses

A purchaser of a townhouse or house receives “fee simple” ownership of real property. The owner is responsible for payment of real estate taxes and common charges such as but not limited to water, electric, gas, as well as insurance. The owner is also solely responsible for approving the sale or lease of the property. When owning your home, all equipment, repairs and upkeep such as roof, heating/cooling, windows, outdoor structures, hot water, electrical systems, video monitor and anti-theft systems are maintained by the homeowner, unless a property manager is hired. In addition to single family townhomes, some properties are designated as multi-dwelling, i.e., 2- to 4-family homes. Check with your attorney about the possibility of increasing or decreasing such designations. Keep in mind that homes which are larger than 4-family are considered a commercial purchase.

Edwin Josue is a Licensed Associate Real Estate Broker at Halstead Manhattan, LLC located at 499 Park Avenue, 14th Fl., NY, NY 10022. He can be reached at O: 212-381-3304 C: 917-560-6874 or at ejosue@halstead.com. Halstead.com

Edwin Josue is a Licensed Associate Real Estate Broker at Halstead Manhattan, LLC located at 499 Park Avenue, 14th Fl., NY, NY 10022. He can be reached at O: 212-381-3304 C: 917-560-6874 or at ejosue@halstead.com. Halstead.com

© The FilAm 2019 Promoted Content

Thank you for the good writeup.