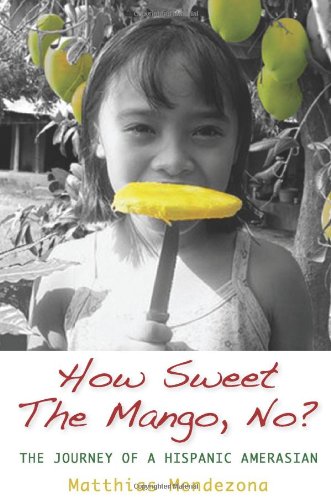

OFF THE WALL: Lockheed Martin: An ethical dilemma

By Daniel de la Rosa

About two years ago, I invested some money in the tobacco manufacturer Philip Morris. There was some uneasiness at first for ethical reasons, but it was a good entry price, the dividends were robust, and it looked like the share price was going straight north.

While cigarette consumption was on the decline in developed countries, it was rising in Asia and other parts of the world.

Then the wife asked why I would invest in a company whose products cause cancer and basically kills people. I couldn’t get my way around what she said so I sold my modest holdings.

A few months later, I opened a position in Lockheed Martin (LMT), something I have been keen to do for quite some time because I wanted exposure in a defense stock that does cutting-edge aerospace research.

Lockheed produces everything from guns to missiles, develops cyber security machinery and protocols, manufactures the F-22 Raptor jet and is developing the F-35 Lightning, an all-weather, stealth multi-role fighter. It is the biggest manufacturer of arms in the world, most of it going into the defense of the United States.

Its armaments are sold to major U.S. allies such as Israel and Japan, the U.K. and South Korea among others countries. The F-16 jet it developed can be found as the backbone of the air force of countries, such as Israel and Saudi Arabia, both of whom are also close allies of the United States. You can throw in all of the NATO countries from Britain to Poland who use weapons from the U.S. for their armies.

I now have a reasonable amount of shares at an average cost of about $110.00, having first purchased the stock back in early 2013. Even after the Friday sell-off, I am up almost 78 percent on the investment as those shares are now worth around $9,950.

For most of the past several months, my paper gains were double my initial investment and the total value of the shares easily topped $10,000.

In short, what’s not to like about LMT?

Analysts from The Street forecast the price target for Lockheed at almost $260 per share. Since I got in at $109.80 per share, that would be a gain of about 136.8 percent if the price target is hit.

“The company has generated more income per dollar of capital than 90 percent of the companies we review,” The Street said in report rating the company as a buy. The annual dividend per share is a hefty $6 per share, which means a yield of slightly over 3 percent.

“The company’s dividend is higher than 80 percent of the companies we track,” The Street added. In a word, Lockheed Martin is an outstanding investment.

That being the case, a good friend asked why I would invest in a company that makes guns that kill people. Isn’t that a crass calculation that since people and nations will continue fighting till the end of time, my investments should be secure? It’s the same dilemma as Philip Morris knocking me on the head all over again.

“Increasing threats and the need to safeguard the interest of nations and people have pushed up demand for U.S. weapons exports to an all-time high, benefiting the U.S. defense manufacturers,” a report by Zacks last week said. I’m holding on to that statement while looking at my glass half full.

For now, I will do what the U.S. Congress has been doing: Kicking the can down the road because I am not really sure what the call should be.

‘Off the Wall’ is a regular column on the stock market. The comments expressed are the author’s own, and are not meant to recommend the buying or selling of stocks.