OFF THE WALL: The first-timer’s guide to stockpicking

By Rene PastorStarting this week, The FilAm is running a regular column on the stock market to be written by Rene Pastor, a long-time business journalist and commodities analyst. Rene writes analyses for Southeast Asia Commodity Digest, an affiliate of Informa Economics based in Memphis, Tenn. Prior to SACD, he was a financial journalist for Reuters for almost 23 years. The comments expressed here are the author’s personal views and are not meant to recommend the buying or selling of stocks.

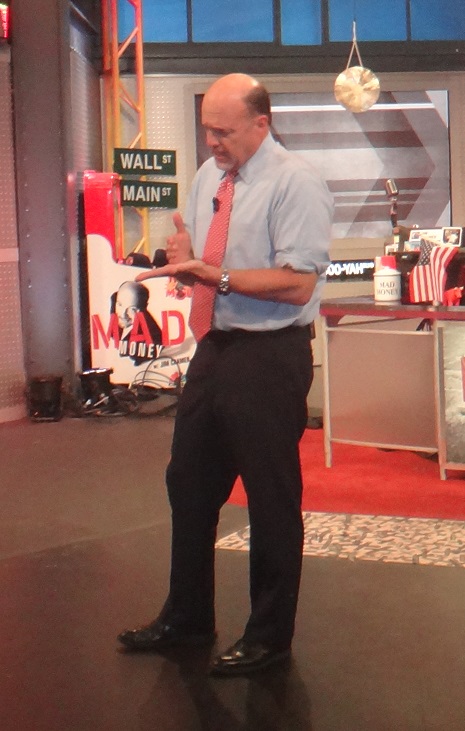

I looked around the mid-afternoon reception for the taping of Jim Cramer’s “Mad Money,” and then it hit me: Almost everyone looked like they belong to the Baby Boomer generation, geezers with lots of time on their hands playing the stock market. How could I tell: No one was fingering their iPhones, taking pictures of what was going on. Definitely no one was doing a ‘selfie’ snapshot for Instagram.

My IRA stock account is in TD Ameritrade, a big sponsor of “Mad Money.” As a treat, select account holders were invited to be the studio audience on Cramer’s show in Englewood Cliffs, New Jersey, on the last day of July.

Since I transferred my 401K to an IRA account in TD, I decided to start choosing my own stocks. Others would have a mutual fund do it, but I’d rather do it on my own and be in control.

That’s how this geezer got into stock picking.

I think the first lessons I learned going into this business are the following:

1. Buy a stock if you understand the company’s business or at least you have an idea what it is doing. If you’re a Starbucks regular, for example, their stocks might be attractive compared to a company that makes nitrogen fertilizer for biodynamic farming.

2. If you think that 10 years down the road, the company will still be around going strong, buy.

3. Price matters. Always.

First, get your homework done. That means going through the numbers, and getting your hands on any research report done on the company. Here’s a caveat though: The research report is not the Bible. It is very useful, but it’s like the Sports Illustrated report on who will win the Super Bowl. Lots of times, they’re both wrong or worse, they miss out on which is the hot team.

Don’t buy a stock whose price is too high or near a one-year peak. As they say in the movie “The Mummy,” patience is a virtue.

Wait for the stock to pull back some and then pull the trigger. The only exception is if you think the stock is going to shoot up another 20 percent and you want to get a position in the company now.

When do you know that is going to happen? I don’t and you don’t. At that point, you rely on your instinct about when is the right time to buy. In short, your call.

One more point. Use limit orders as much as you can.

A limit order would include the minimum or maximum price you will pay for a stock. The only problem with this approach is if the stock runs away from you and you have to decide whether to chase down the stock or not. If you have a few hours before the market closes at 4 p.m., wait until 3:30 or no later than 3:45 and decide if you want to pay up or pass for the day and come back tomorrow morning to see if the stock retreats a little.

What do I look for? I like two-way stocks.

When I think of Johnson and Johnson, I think of baby powder and baby oil. But they also develop drugs and give out a pretty good dividend of 66 cents a share. That’s $2.64 in a year and it looks like they will keep bumping it up.

I also like Boeing. Along with Airbus from Europe, they have a duopoly in the commercial airline business. It is also, behind Lockheed Martin, the second biggest arms maker on the planet. The next time you think of the B2 or the B52 Superfortress bomber, think Boeing.

Hang on to the shares of both companies and if you tell your broker to reinvest your dividends in more stock of the company, your shares will just keep growing without you getting off the couch. Simple as that.

Remember, the more you think you know how the market behaves, it has a way of making you look like an idiot. Even the smartest guys in the room know that.

Thank you very much Mr. Pastor for the informative information about buying stock.

I think its an excellent idea for you to writ a weekly finical column of the Fil-Am.

Indeed, I do look forward in reading your upcoming column on The Fil-Am

Best of wish on your new writing venture Sir,

M. Matthews